Lumina Case Study: Rapyd

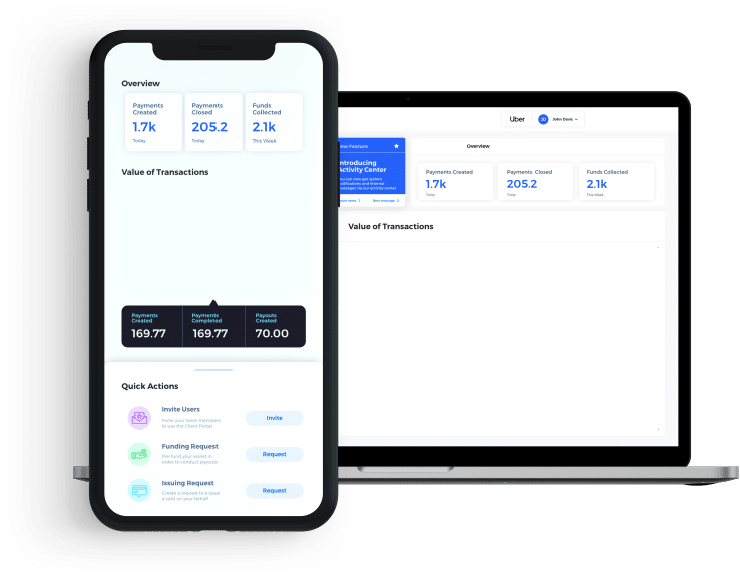

Lumina began working with Rapyd in the early days of the online payments boom as the company sought to bring a truly unique capability to the fintech market. As transactions became increasingly digital, Rapyd differentiated itself by creating a self-described “swiss army knife” suite of financial services capabilities, covering payments to currency transfers, ID verifications and card issuing – all with a single API. The company also described itself – and this growing market – as a “fintech as a service” play, akin to “AWS for financial services.”

These capabilities aimed to close a significant gap in the payments economy as merchants around the world, gig economy firms, online lenders and banks were often unable to provide access to funds instantly due to the many challenges of accepting and making payments in local geographies through existing, often antiquated channels.

The company would later raise a Series C round ($100M), including participation ($20M) from Henry Ellenbogen, formerly a star investor at T. Rowe Price. The strength and credibility of the brand would be critical to its success.

Notably, the PR team aimed to support these transactions and the company’s growth by creating strong PR tailwinds to build a powerful US and global brand for Rapyd.

The team created an aggressive PR program that would support Rapyd’s growth from a relative unknown to a $1B+ fintech ‘unicorn’ by featuring critical aspects of the story.

- The team highlighted Rapyd’s prominence and investment appeal with backing from Stripe, another payments unicorn, as well as key VCs, including General Catalyst, which had also invested in Stripe, among others. Namely, this capital raise would play into the massive online payment boom that also made Stripe one of the most sought-after payment start-ups in Silicon Valley.

- We also highlighted the significance of Rapyd’s model, solving a major problem for merchants and consumers around the world by also highlighting the consumer appeal and human impact, as people were unable to buy items in various economies, and major businesses had challenges hiring employees, especially in gig economy jobs around the world due to severe limitations in payments. Notably, Rapyd’s technology offers a highly compelling value proposition, providing a single point of reconciliation and settlement of all funds across 100+ currencies, which helps merchants clear a major hurdle in cross-border payments.

The team secured 100+ placements for Rapyd in the business, fintech, VC, and payments trade press. Articles highlighted Rapyd’s unique value proposition, growing valuation as a new ‘unicorn’, as well as the company’s ability to disrupt its market.

Notably, TechCrunch featured the “swiss army knife” of fintech reference in two feature articles about the company, and Rapyd’s messaging resonated very well with the press. The team also secured commentary and thought leadership articles in key publications to create a strong external profile for key leaders at the company. The visibility and third-party credibility that Lumina created for Rapyd helped the company raise its second $100M round and move its business forward more effectively.